The Cyprus Holding Company & Possible Tax Implications

A Cyprus Holding Company is a company holding and managing participations in other local or foreign companies. It may, however, also engage in other activities according to the terms of its Memorandum of Association. Such a company is an extremely useful investment vehicle for foreigners due to the Cypriot taxation regime.

Corporation tax

A Cyprus Holding Company, like any other “resident” company, is taxed at a rate of 12.5% on the income that accrues in or derives from all sources in Cyprus or abroad, which is among the lowest tax rates within the European Union. Any profit from a Permanent Establishment, e.g. office, factory etc, in another jurisdiction is exempt from taxation in Cyprus.

Dividends

Tax treatment of incoming dividends: Dividend payments are not generally subject to any Income Tax but are subject to 17% Special Defence Contribution Tax. However, there is an international participation exemption and thus the dividends received by a Cyprus Holding Company from a foreign participation are exempt from the Special Defence Contribution Tax provided that more than 50% of the paying company’s activities result directly or indirectly in investment income, or, the foreign tax is significantly lower than the tax rate payable in Cyprus. Dividends payable by a Cyprus subsidiary to a Cyprus resident Holding Company are also exempt from taxation.

Withholding tax on outgoing dividends: Outgoing dividends remitted by a Cyprus Holding Company to non-residents, whether a company or individual, do not suffer any withholding tax in Cyprus or any Special Defence Contribution Tax. This applies whether the shareholder is EU resident or not. The full exemption from withholding tax makes Cyprus a more advantageous forum than other EU jurisdictions which impose withholding tax to non-EU residents.

Capital Gains on the Sale of Shares

There is no taxation on the gains from the disposal of securities for any Cyprus Holding Company. This is based on a general tax exemption for profits from the sale of securities in Cyprus and effectively enables the Cyprus Holding Company to dispose of the shares in a subsidiary without adverse tax implications suffered in Cyprus. Capital gains tax is, however, imposed on gains from sale of shares of companies owning immovable property in Cyprus. It is worth noting that trading gains realised by a Cyprus resident company through disposal of securities are also exempt from tax.

Double taxation treaties

Cyprus has a wide network of double taxation treaties that provides for reduced withholding tax rates on dividend received from Treaty countries. Consequently, incoming dividends received by a Cyprus Holding Company from its foreign participations are either fully exempt from or subject to a very low withholding tax in the subsidiaries’ jurisdiction.

Interest Income and Expenses

Withholding tax on interest received: There is a 30% Special Defence Contribution Tax on any interest income received by a Cyprus Holding Company from any source, whether in Cyprus or abroad. However, there is an exception in the case of interest income earned from ordinary business activities or closely related to ordinary business activities.

Withholding tax on interest paid: Cyprus does not impose any withholding tax on the payment of interest made to non resident recipients.

Interest deduction for borrowing costs: Interest expenses payable by a Cyprus Holding Company are fully deductible. Therefore, a Cyprus Holding Company may be capitalised with loans from the parent company and the interest paid at arms length to the parent company will be deductible.

Thin capitalization

There are no rules concerning capitalization (debit to equity ratio) of companies, thus a Cyprus Holding Company may be capitalized with loans without any risk that the interest paid at arm’s length to the parent company will not be deductible.

Liquidation

The liquidation of participations held by the Cyprus Holding Company does not give rise to any taxes in Cyprus. Upon liquidation of a Cyprus Holding Company, all profits of the past five years are deemed to have been distributed to the shareholders. Distributions to non-resident shareholders are not taxable whereas distribution to resident shareholders is taxed with Special Defence Contribution Tax.

EU Benefits

A Cyprus Holding Company enjoys the benefits of the Parent-Subsidiary EU which Directive allows, upon certain conditions being met, for a withholding tax exemption in relation to dividends between an EU-based subsidiary and an EU-based parent company. Moreover, reorganizations within the scope of the EC Merger Directive can be effected without any corporation tax, capital gains tax or transfer fees.

Additional benefits:

- Group loss relief

- Tax losses can be carried forward and set off against the profits fo the next five years

- Unilateral tax credit relief for any tax paid abroad

- Tax-free exit

Given this regime, the Cyprus Holding Company can be considered as one of the most advantageous investment vehicles in the EU and investors may derive important tax benefits from using it. It is subject to one of the lowest corporate tax rates in the EU on its income, it generally pays no tax on dividends received from any foreign or local subsidiary, it is charged with no withholding tax on payments of dividends made to non-Cyprus resident recipients and any trading gains realised through the disposal of shares is exempt from taxation.

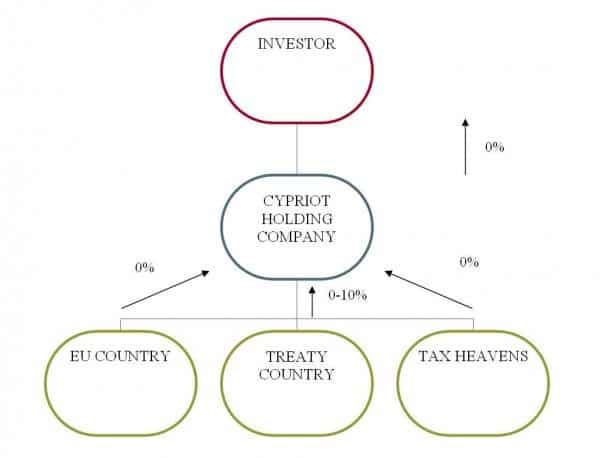

A summary of the tax treatment of dividends received and distributed by a Cypriot Holding Company:

Please refer to our Website Disclaimer.